How I Nailed My Car Loan Timing — And Saved Way More Than I Expected

So you’re thinking about buying a car? Yeah, me too — and I quickly realized the real game isn’t just picking the right model, but nailing the timing of your loan. I tried rushing it once — big mistake. Ended up overpaying and stressed out. But after testing a few strategies, I found a smarter way. This isn’t just about rates or credit scores — it’s about syncing your move with life, finances, and even the calendar. Let me walk you through how timing transformed my car loan from a burden into a smart financial play.

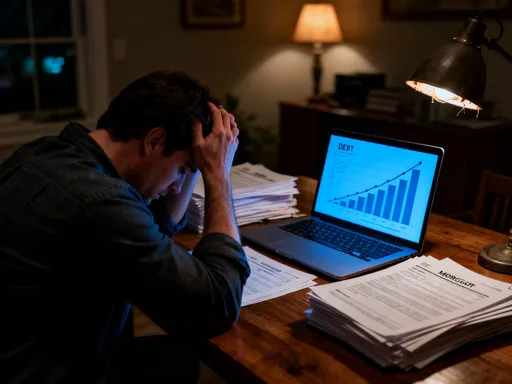

The Hidden Cost of Bad Timing

Many car buyers focus on the sticker price or monthly payments, but few consider how the timing of their loan application can silently inflate the total cost. A poorly timed decision can lead to higher interest rates, weaker negotiating power, and longer repayment periods — all of which add up over time. For instance, applying for a car loan immediately after a major life expense, such as a home renovation or medical bill, may coincide with a dip in available cash flow or a temporary drop in credit score. Lenders assess these factors closely, and even a slight decline in financial standing can result in less favorable loan terms.

Consider this scenario: two people with nearly identical credit profiles apply for the same loan, but one applies right after maxing out a credit card during holiday shopping, while the other waits until debts are paid down and credit utilization is low. The second applicant is likely to receive a lower interest rate, not because of a better credit score on paper, but because their financial behavior at the time of application appears more responsible. This difference might seem minor — perhaps just half a percentage point — but over a five-year loan on a $25,000 vehicle, it could mean hundreds of dollars in savings.

Additionally, timing affects more than just interest rates. It influences your confidence and clarity during negotiations. When you're financially stretched or under pressure to secure transportation quickly, you're more likely to accept unfavorable terms. You might agree to a longer loan term to reduce monthly payments, not realizing that this increases the total interest paid over time. Or you might overlook fees and add-ons that inflate the final cost. These decisions, made in moments of urgency, often stem from poor timing rather than poor planning. The key is recognizing that timing is not passive — it’s a strategic element of financial decision-making.

Lenders also operate on cycles. Their risk assessments, promotional offers, and internal sales targets fluctuate throughout the year. Applying during a period when a lender is pushing volume — such as the end of a quarter — can work in your favor. Conversely, applying during a tight credit market or when economic uncertainty is high may lead to stricter approval standards. Understanding these rhythms allows you to act when conditions are most favorable, rather than reacting to immediate needs.

When Your Finances Are Actually Ready

Wanting a new car is natural, especially when old models show signs of wear or when family needs change. But desire doesn’t equal financial readiness. True readiness involves a clear assessment of income stability, credit health, debt levels, and emergency preparedness. Jumping into a car loan before these elements are in place can turn a practical purchase into a long-term financial strain.

Start with income stability. Are your earnings consistent month to month? If you rely on variable income — such as freelance work, seasonal employment, or commission-based pay — it’s wise to wait until you have several months of predictable cash flow. Lenders look for proof of reliable income, and so should you. A steady paycheck not only improves your chances of approval but also ensures you can comfortably manage monthly payments without sacrificing other essentials.

Next, evaluate your credit score. While many lenders offer loans to borrowers across a range of credit tiers, a higher score typically unlocks better interest rates and terms. A score below 600 may still qualify you for financing, but the cost will be significantly higher. If your score is below 680, it’s worth delaying your purchase to improve it. Simple steps like paying down balances, correcting errors on your credit report, and avoiding new credit applications can boost your score within a few months.

Equally important is your debt-to-income (DTI) ratio — the percentage of your monthly income that goes toward debt payments. Most lenders prefer a DTI below 36%, including the new car payment. Calculate your current obligations — mortgage or rent, credit cards, student loans, and other debts — then add the estimated car payment. If the total exceeds one-third of your income, consider waiting or adjusting your budget. A high DTI not only reduces approval odds but also increases financial stress, making it harder to handle unexpected expenses.

Finally, confirm that you have an emergency fund. Life rarely goes according to plan. A flat tire, a medical visit, or a sudden job change can disrupt your budget. Without savings, a car payment can become overwhelming. Ideally, you should have three to six months’ worth of living expenses set aside before taking on a new loan. This cushion allows you to absorb surprises without falling behind on payments or relying on high-interest credit cards.

The Calendar Secrets Lenders Don’t Tell You

Car buying isn’t just a personal decision — it’s influenced by broader market cycles and dealership incentives. Savvy buyers know that timing a purchase around these patterns can lead to significant savings. The automotive industry operates on quarterly and annual cycles, and dealerships often push to meet sales targets by the end of each month, quarter, or calendar year. These periods create opportunities for better deals, lower financing rates, and added incentives.

The last week of the month is particularly strategic. Sales teams are working to hit monthly quotas, and managers may have the authority to approve deeper discounts or favorable loan terms to close deals. Similarly, the end of a quarter — March, June, September, and December — often brings manufacturer-backed promotions. Automakers may offer cash rebates, subsidized financing, or bonus trade-in values to boost sales numbers. These incentives are designed to move inventory, not to maximize profit per vehicle, making them ideal for buyers.

Holidays also present buying advantages. Memorial Day, Labor Day, Fourth of July, and Thanksgiving weekends are traditionally paired with “sales events” that include reduced interest rates or cash-back offers. While these promotions are widely advertised, many buyers don’t realize how much negotiating room still exists. A posted 0% financing deal, for example, may be available only to buyers with excellent credit, but even those with good credit can often negotiate lower rates than standard offerings.

Inventory levels also affect timing. When a new model year arrives, dealerships need to clear out previous year models. This usually happens in late summer or early fall, creating a window of opportunity for discounted pricing. Similarly, vehicles that have been sitting on lots for several months may be marked down to make room for incoming shipments. Buyers who are flexible on color or trim level can find substantial savings during these overstock periods.

On a macro level, interest rate environments matter. When the Federal Reserve lowers benchmark rates, auto loan rates often follow. While this doesn’t mean every borrower gets a better deal automatically, it shifts the baseline. Monitoring economic trends and understanding how they affect lending can help you choose the right moment to apply. For instance, securing a loan during a low-rate cycle can lock in savings for the life of the loan, especially if you opt for a fixed-rate product.

Credit Moves That Pay Off Before You Apply

Your credit profile is one of the most powerful tools in securing a favorable car loan — but its impact depends on what you do in the months leading up to your application. Lenders evaluate not just your credit score, but your recent financial behavior. A few strategic moves well in advance can significantly improve your terms.

Six months before applying, focus on reducing credit utilization. This is the ratio of your outstanding credit card balances to your total credit limits. Experts recommend keeping it below 30%, but aiming for under 10% can have an even greater positive effect on your score. Pay down balances methodically, starting with high-interest cards. Avoid closing old accounts, as this can shorten your credit history and reduce available credit, potentially increasing utilization.

Three months out, check your credit reports from all three major bureaus — Equifax, Experian, and TransUnion. You’re entitled to one free report from each per year at AnnualCreditReport.com. Look for errors such as incorrect late payments, accounts you don’t recognize, or outdated information. Dispute any inaccuracies immediately. Resolving these issues can take time, so starting early ensures corrections are reflected before your loan application.

In the final 30 to 60 days before applying, avoid opening new credit accounts or making large purchases on credit. Each hard inquiry from a lender can temporarily lower your score by a few points, and multiple inquiries in a short period may signal financial distress. While rate shopping for auto loans is generally treated as a single inquiry if done within a 14- to 45-day window (depending on the scoring model), it’s still wise to limit applications to a focused period.

Also, avoid making large cash deposits or unusual transactions that could raise red flags during income verification. Lenders may request documentation to confirm the source of funds, and inconsistencies can delay approval. Keeping your financial activity consistent and transparent builds trust and streamlines the process.

These steps don’t require drastic changes — just disciplined habits. The goal isn’t perfection, but progress. Even a 20- to 30-point increase in your credit score can move you into a lower interest rate tier, saving hundreds over the life of the loan. Think of it as paying yourself first: the effort you put in now returns in the form of lower monthly payments and reduced total cost.

Negotiating From Strength — Not Desperation

Confidence at the dealership starts long before you walk onto the lot. It begins with preparation. Buyers who negotiate from strength have done their research, secured pre-approval, and defined their budget. They aren’t reacting to pressure — they’re guiding the conversation. In contrast, those who feel urgency — perhaps due to a broken-down vehicle or an expiring lease — often accept terms they wouldn’t otherwise consider.

Pre-approval is one of the most powerful tools in your arsenal. It means a lender has already reviewed your credit and income and agreed to lend you a specific amount at a set rate. With pre-approval in hand, you know exactly how much you can spend and what your payments will be. More importantly, it shifts the power dynamic. Instead of relying on dealership financing, you can compare their offer to your pre-approved rate and walk away if it’s not competitive.

Shopping around amplifies this advantage. Don’t assume your bank or credit union offers the best rate — check online lenders, national banks, and even manufacturer financing programs. Each may have different promotions or eligibility criteria. Comparing at least three offers gives you leverage and ensures you’re not leaving money on the table.

When negotiating, focus on the total out-the-door price, not just the monthly payment. Salespeople may offer low payments by extending the loan term to 72 or 84 months, but this increases total interest paid. A shorter loan — 48 or 60 months — typically saves money in the long run, even if the monthly amount is higher. Stick to your budget and resist the temptation to stretch it because “the payment fits.”

Also, negotiate the price of the car separately from the financing. Agree on the vehicle price first, then discuss loan terms. This prevents the dealer from inflating the price to offset a low interest rate or vice versa. Bring your own calculations and be ready to walk away. The ability to say “no” is the ultimate source of negotiating power.

The Trap of “Too Good to Be True” Deals

Some offers sound irresistible: 0% financing, $1,000 cash back, no money down. But buried in the fine print are often conditions that undermine the savings. These deals may require excellent credit, limit eligibility to specific models, or include extended loan terms that cost more over time. Emotional timing — the fear of missing out — can override rational decision-making, leading buyers to sign agreements they later regret.

Take 0% financing. While it eliminates interest, it’s usually reserved for buyers with credit scores above 720. Even then, the term may be shorter — 36 or 48 months — resulting in higher monthly payments. If you can’t afford the payment, you might be pushed into a longer, interest-bearing loan instead. Additionally, these offers are often non-negotiable on price, meaning the vehicle may be sold at full sticker value, canceling out any interest savings.

Another red flag is “no down payment” financing. While it reduces upfront costs, it increases the loan amount, leading to higher interest charges and a greater risk of being upside-down on the loan — owing more than the car is worth. This is especially dangerous in the early years of ownership, when depreciation is steepest. Without equity, selling or trading in the vehicle becomes difficult without adding cash out of pocket.

Extended warranties, maintenance packages, and credit insurance are often pushed alongside financing. While some may offer value, many are overpriced or unnecessary. These add-ons inflate the loan balance and monthly payment. Always evaluate them separately and decline anything you don’t fully understand or truly need.

The best defense is skepticism. Ask questions: What’s the APR after the promotional period? Can I get this rate on the model I want? Is the price negotiable? Read the contract thoroughly before signing. If something feels off, walk away. A good deal won’t vanish overnight — and a bad one can haunt you for years.

Building a Personal Loan Game Plan

The most successful car buyers don’t rely on luck — they create a plan. This means aligning your loan timing with your personal financial rhythm. Consider when your income is most stable: Are you paid monthly, biweekly, or do you receive annual bonuses? Scheduling your first payment to coincide with your payday reduces the risk of missed payments. If you get a year-end bonus, plan to use part of it as a down payment, which lowers your loan amount and improves your loan-to-value ratio.

Think about your annual expense cycle. Are there months when bills are lighter? Starting a loan during a low-expense period gives you breathing room to adjust to the new payment. Avoid timing a car purchase around other big expenses, like back-to-school shopping, holiday spending, or property tax payments. Stacking major costs increases financial stress and reduces flexibility.

Life events also matter. A job change, a growing family, or a move to a new city can all influence your transportation needs and budget. Build in a buffer: if you anticipate a change in income or expenses, wait until it stabilizes before committing to a loan. Patience pays off in the form of better terms and greater peace of mind.

Your game plan should include a timeline: when to start improving your credit, when to begin shopping, when to apply for pre-approval, and when to make the purchase. Set milestones and track progress. This turns car buying from a reactive scramble into a deliberate, confident move.

Ultimately, timing a car loan isn’t about waiting for perfection — it’s about creating advantage. It’s using knowledge, preparation, and patience to turn a necessary expense into a smart financial decision. When you control the timing, you control the outcome. And that makes all the difference.